How To Calculate Your Mortgage Payment

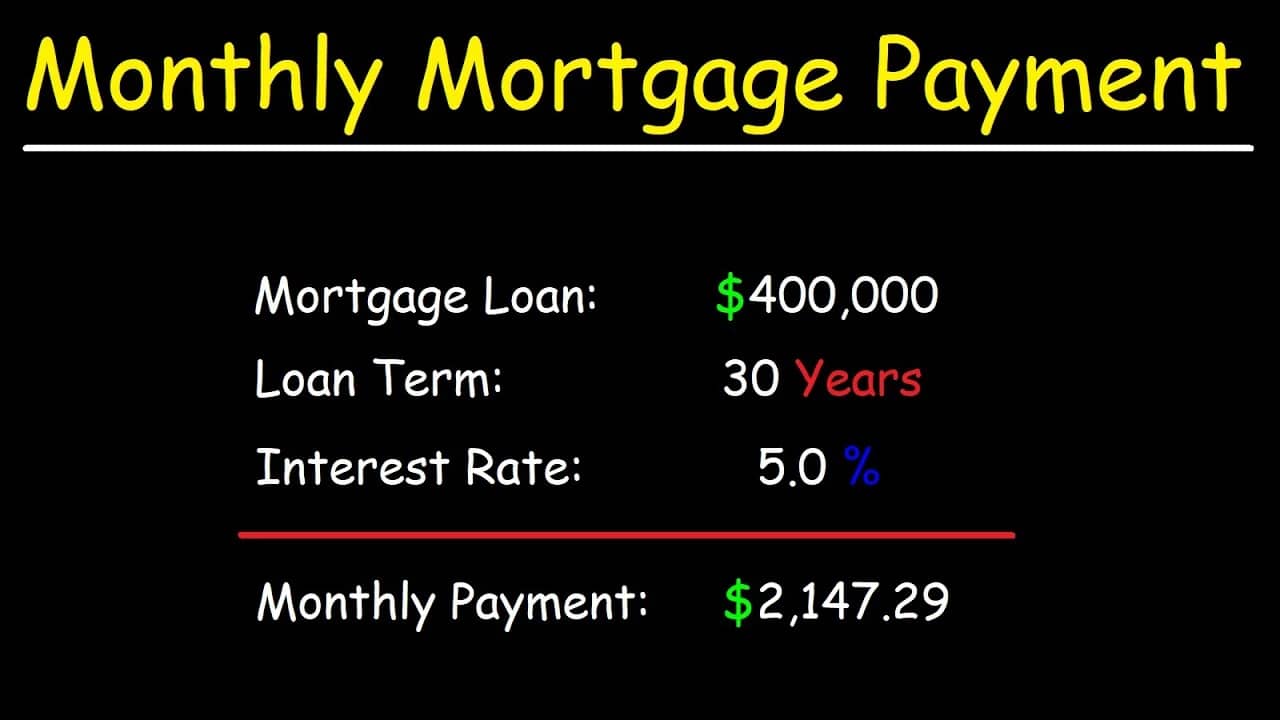

If you’re taking out a mortgage to buy a home, understanding how to calculate your monthly payment is essential. Let’s break it down with an example: a $400,000 loan with a 30-year term and a fixed annual interest rate of 5%. Here’s how you can determine your monthly payment using a simple formula.

The Mortgage Payment Formula

The formula to calculate your monthly mortgage payment is:

Monthly Payment=P×rn underscore 1−(1+rn)−n×t Monthly Payment=1−(1+nr)−n×tP×nr

Where:

- P = Principal loan amount ($400,000 in this case)

- r = Annual interest rate (5%, or 0.05 as a decimal)

- n = Number of payments per year (12 for monthly payments)

- t = Loan term in years (30 years)

Step 1: Plug in the Numbers

Let’s assign the values to the variables:

- P = $400,000

- r = 0.05 (5% converted to a decimal)

- n = 12 (monthly payments)

- t = 30 (loan term in years)

Now, plug these into the formula:

[

\text{Monthly Payment} = \frac{400,000 \times \frac{0.05}{12}}{1 – (1 + \frac{0.05}{12})^{-12 \times 30}}

]

Step 2: Simplify the Equation

- Calculate r/n:

[

\frac{0.05}{12} = 0.0041667

] - Multiply the principal by r/n:

[

400,000 \times 0.0041667 = 1,666.67

] - Calculate the exponent part:

[

-n \times t = -12 \times 30 = -360

] - Compute the denominator:

[

1 – (1 + 0.0041667)^{-360}

] First, calculate (1 + 0.0041667 = 1.0041667).

Then, raise this to the power of -360:

[

(1.0041667)^{-360} \approx 0.2238

] Finally, subtract this from 1:

[

1 – 0.2238 = 0.7762

]

Step 3: Calculate the Monthly Payment

Now, divide the numerator by the denominator:

[

\text{Monthly Payment} = \frac{1,666.67}{0.7762} \approx 2,147.29

]

So, your monthly mortgage payment would be $2,147.29.

Why This Matters

Knowing how to calculate your monthly payment helps you budget effectively and understand the long-term costs of your mortgage. In this example, a $400,000 loan at 5% interest over 30 years results in a monthly payment of $2,147.29. Over the life of the loan, you’ll pay a total of $773,024.40, with $373,024.40 going toward interest.

Online Mortgage Calculator

While the formula might seem complex at first, breaking it down step by step makes it manageable. If math isn’t your strong suit, there are plenty of online mortgage calculators that can do the heavy lifting for you. However, understanding the process empowers you to make informed decisions about your home loan.

Whether you’re a first-time homebuyer or refinancing, knowing your monthly payment is key to planning your financial future. Happy house hunting!

Note: Always consult with a financial advisor or mortgage professional to ensure accuracy and to explore your specific loan options.

Subscribe to our newsletter!

Recent Posts

- Mortgage Strategy 2025: Navigating the Future of Real EstateThe real estate market is constantly evolving, and as we look ahead to 2025, it’s clear that both homeowners and investors need a solid mortgage strategy to navigate the challenges and opportunities ahead.

- How a Mortgage Actually WorksThe world of real estate can feel overwhelming, especially if you’re new to it. With so many terms and concepts to grasp, buying a home might seem like a daunting

- How to Get Out of a MortgageIf you’re feeling stuck in your mortgage or simply exploring your options, you’re not alone. Many homeowners in the United States and United Kingdom find themselves wondering how to get out of a mortgage.

- How to Qualify for a Mortgage with Student Loan Debt in 2025Buying a home is a significant milestone, but for millions of Americans carrying student loan debt, the path to homeownership can feel daunting. The good news? Qualifying for a mortgage

- Mortgage Rates UpdateHey everyone, Dan Freo here with your Closing Bell update for February 14th, 2025. Today, we’re diving into the national deficit, mortgage rates, bond market reactions, and equity movements. But