FHA Loans vs. Conventional Loans

If you’re a first-time homebuyer, you’ve probably heard about FHA and conventional loans. But what’s the difference, and which one is best for you? In this guide, we’ll break it all down in less than 5 minutes, so you can make an informed decision and avoid common pitfalls.

The Basics: FHA vs. Conventional Loans

FHA Loans

- Government-Backed: Insured by the Federal Housing Administration (FHA).

- Flexible Requirements: Designed to help buyers with lower credit scores and smaller down payments.

- Key Features:

- Minimum credit score: 580 (with 3.5% down) or 500 (with 10% down).

- Debt-to-Income (DTI) ratio up to 50%.

- Down payment as low as 3.5%.

Conventional Loans

- Privately Secured: Not backed by the government.

- Stricter Requirements: Ideal for buyers with strong credit and financial stability.

- Key Features:

- Minimum credit score: Typically 620 or higher.

- Lower DTI ratios (usually below 43%).

- Down payment as low as 3% (for qualified buyers).

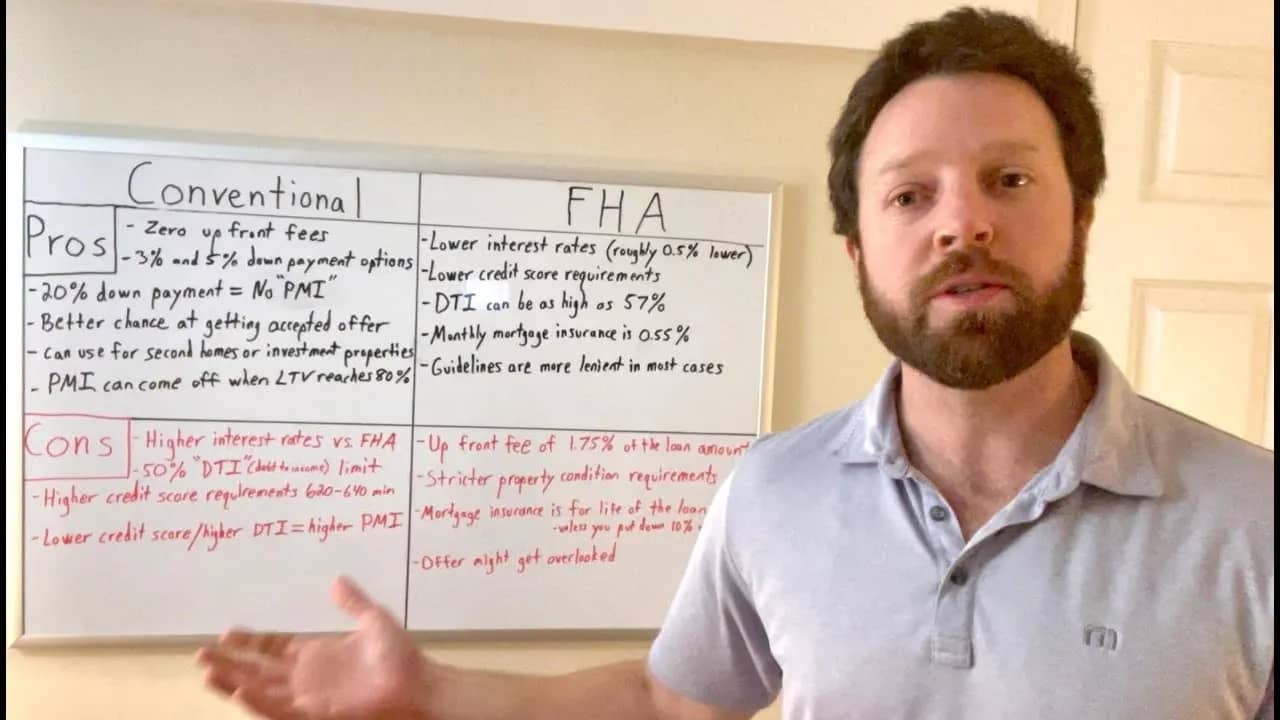

Pros and Cons of FHA Loans

Pros

- Lower Credit Score Requirements: Perfect for buyers with less-than-perfect credit.

- Low Down Payment: Only 3.5% down for credit scores of 580+.

- Seller Credits: Sellers can contribute up to 6% of the purchase price toward closing costs (vs. 3% for conventional loans).

- Lower Interest Rates: Often more competitive than conventional loans.

Cons

- Mortgage Insurance Premiums (MIP):

- Upfront MIP: 1.75% of the loan amount (can be rolled into the loan).

- Annual MIP: 0.55% of the loan balance, paid monthly.

- Duration: MIP lasts for the life of the loan if you put down less than 10%.

- Property Requirements: Homes must meet FHA standards (safe, livable, and free of major repairs).

- Primary Residence Only: Cannot be used for investment properties or second homes.

Pros and Cons of Conventional Loans

Pros

- No Mortgage Insurance with 20% Down: Avoid PMI (Private Mortgage Insurance) if you put down 20% or more.

- Flexible Terms: Can be used for primary residences, second homes, or investment properties.

- Lower Fees: No upfront mortgage insurance premium.

- Higher Loan Limits: Ideal for higher-priced homes.

Cons

- Stricter Credit Requirements: Minimum credit score of 620+.

- Higher Down Payment: Typically 5-20% down, depending on the lender.

- Lower Seller Credits: Sellers can only contribute up to 3% toward closing costs.

Common Misconceptions About FHA Loans

- Myth: FHA loans are only for first-time homebuyers.

Fact: Anyone can use an FHA loan, as long as they meet the requirements. - Myth: FHA loans are only for people with bad credit.

Fact: Even buyers with excellent credit can benefit from FHA loans, especially if they want to preserve cash for other investments. - Myth: FHA loans are harder to get approved.

Fact: FHA loans are often easier to qualify for due to their flexible requirements. However, the property must meet FHA standards, which can sometimes complicate the process.

How to Choose the Right Loan for You

- Evaluate Your Financial Situation:

- Check your credit score and DTI ratio.

- Determine how much you can afford for a down payment.

- Consider Your Long-Term Goals:

- If you plan to stay in the home long-term, FHA loans can be a great option.

- If you want to avoid mortgage insurance or buy an investment property, conventional loans may be better.

- Work with a Trusted Team:

- A knowledgeable real estate agent and lender can help you navigate the process and present your offer confidently, especially if you’re using an FHA loan.

FHA Loan and Conventional Loan: Pros and Cons

Both FHA and conventional loans have their pros and cons, and the right choice depends on your unique financial situation and homebuying goals. FHA loans are a fantastic option for buyers with lower credit scores or limited savings, while conventional loans offer more flexibility and lower costs for financially stable buyers.

The key is to work with a trusted real estate team who can guide you through the process and help you make the best decision for your future.

Have questions about FHA or conventional loans? Drop them in the comments below, and I’ll be happy to help! For more tips and insights, check out my other home loans on the housing market.

Subscribe to our newsletter!

Related Posts

- Mortgage Strategy 2025: Navigating the Future of Real EstateThe real estate market is constantly evolving, and as we look ahead to 2025, it’s clear that both homeowners and investors need a solid mortgage strategy to navigate the challenges and opportunities ahead.

- How a Mortgage Actually WorksThe world of real estate can feel overwhelming, especially if you’re new to it. With so many terms and concepts to grasp, buying a home might seem like a daunting

- How to Get Out of a MortgageIf you’re feeling stuck in your mortgage or simply exploring your options, you’re not alone. Many homeowners in the United States and United Kingdom find themselves wondering how to get out of a mortgage.

- How to Qualify for a Mortgage with Student Loan Debt in 2025Buying a home is a significant milestone, but for millions of Americans carrying student loan debt, the path to homeownership can feel daunting. The good news? Qualifying for a mortgage

- Mortgage Rates UpdateHey everyone, Dan Freo here with your Closing Bell update for February 14th, 2025. Today, we’re diving into the national deficit, mortgage rates, bond market reactions, and equity movements. But